LMNP for Dummies

[vc_row][vc_column][us_separator size=”small”][vc_column_text]Non-professional furnished property (location meublée non professionnelle, or LMNP) is a popular choice among lessors. However, one of the most significant advantages is often overlooked, namely the possibility of opting for the régime réel, tax scheme whereby entrepreneurs and companies are taxed on the basis of income earned each year. To help you truly […]

Why should you work with a specialised mortgage broker in France?

[vc_row][vc_column][us_separator size=”small”][vc_column_text] When you’re looking to invest in property, a traditional mortgage broker in France dedicated to resident individuals will help you very quickly find the best financing at the best rate. The market for lending to non-resident individuals is very different from the traditional mortgage market. For this reason, Carte Financement, a mortgage broker […]

Pre-Brexit property boom : why the British are snapping up homes

[vc_row][vc_column][us_separator size=”small”][vc_column_text]Since 23 June 2016, France has been drawing in Brits, Brexit or not. In 2017, 3,173 British people applied for French citizenship, a level eight times higher than in 2015, when only 386 did so. In terms of completing the process, 1,518 British people actually obtained French citizenship in 2017, versus 320 in 2015. […]

Top 5 of what you need to know before selling a property in France

[vc_row][vc_column][us_separator size=”small”][vc_column_text] 1 – Before selling a house in France, prepare the list of required documents To complete your property sale in compliance with French laws, you will have to provide a number of documents to future buyer(s). In particular, you will have to have a technical inspection file (DDT in French) prepared at your […]

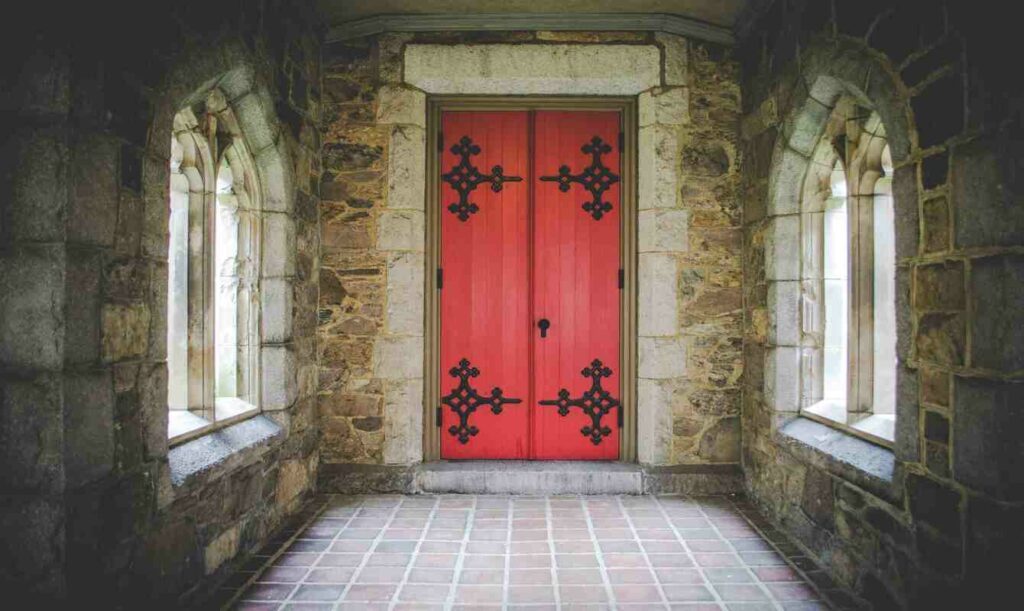

Financing a castle in France from Panama : Testimony

[vc_row][vc_column][us_separator size=”small”][vc_column_text]Certain countries and certain types of properties are more difficult to finance than others for banks. Being a non-resident in Panama and applying for a mortgage to purchase a château in France is, for example, a situation which the latter have sometimes had difficulty facing. Using a mortgage broker enables these non-residents with complex […]

Mortgages : guide to use of the condition precedent

[vc_row][vc_column][us_separator size=”small”][vc_column_text] The “loi Scrivener” of 13 July 1979 defines a condition precedent during the property purchase process. It aims to protect property buyers, who may previously have been under certain pressure from sellers and estate agents to sign commitments to sell without financing conditions. Therefore, for nearly 40 years, a buyer who makes an offer, […]

Investing in France from the United States despite FATCA

[vc_row][vc_column][us_separator size=”small”][vc_column_text]French people living in the US who wish to invest in France often have difficulty in obtaining loans from French banks, which fear penalties if they violate the US FATCA (Foreign Account Tax Compliance) regulations. One of our customers, who experienced difficulties before contacting us, talks about how she got a loan for her […]

Dictionary of French property – Sales & rental terms

[vc_row][vc_column][us_separator size=”small”][vc_column_text]SALES TERMS / PURCHASE TERMS You might also be interested in : Top 5 of what you need to know before selling a property in France SALES FRENCH TERMS Compromis de vente – Preliminary sales agreement : an initial contract whereby the owner undertakes to sell their property to the buyer at a given […]

French property market trends for this semester

[vc_row][vc_column][us_separator size=”small”][vc_column_text] What are the problems and pitfalls usually faced by foreigners who decide to collaborate with you? The problems and pitfalls encountered by non-residents wishing to buy a property in France are multiple and recurrent. First of all, when looking for property, they often face the following difficulties: offers not updated on online real […]

The top 5 things you should know before buying a property in France !

[vc_row][vc_column][us_separator size=”small”][vc_column_text] Buying a property in France is a tempting prospect, even more so since the interest rates on French property loans are very low right now. You may wish to purchase a flat or a house to use as your primary or even secondary residence, or to have as an asset and earn you […]