[vc_row][vc_column][us_separator size=”small”][vc_column_text]This French region, where life is pleasant, and where the sun shines almost all year round (2,407 hours of sunshine in 2018!), has always also held attractions for international buyers. According to the 2018 edition of the BNP International Buyer Observer, the PACA [Provence Alpes Côte d’Azur] region accounted for 20.7% of transactions by foreign non-residents.

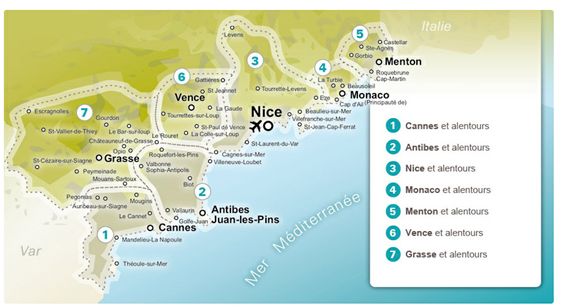

Although the geographical demarcation varies according to the sources, if we use the definition of the French Riviera given by the official tourism site it is the coastal area stretching from Cannes and its surrounding region to the Italian border. In the French Riviera property market, real estate prices in certain districts of the major cities, such as Cannes, Antibes and Nice, dropped over the past ten years due to the 2008 real estate crisis.

However, for several months the French Riviera property market has been regaining vigour.

You might also be interested in this article : Seaside resorts to invest in

Nice, ideal for a rental investment

In the Capital of the Alpes-Maritimes Département prices of older property grew by 1.7% over the past 12 months, according to the LPI-SeLoger barometer. This increase can be explained by a dynamic rental market, which has been generating yields of close to 4.8% on average. The city, which lacks for nothing, attracts many students due to its universities (Edhec, etc.), its renowned technology centre (Sophia Antipolis) and active young companies (Thalès, Amadeus, and many local start-ups).

Average purchase prices per square metre are 4,228 Euros/m², putting the city in fourth place among the most expensive conurbations in France. This average price conceals many disparities since, depending on the districts, prices vary from 3,000 Euros/m² in the West to 10,000 Euros/m² in Mont-Boron or Old Nice. In the Carré d’Or district, which attracts an upmarket clientele and which is very popular with tourists and foreign purchasers, prices are 6,525 Euros/m².

Outside these historic districts, investing close to the future technology centre Nice Méridia (2,500 homes and 150,000 m² of offices) may be an attractive option.

In terms of floor areas, studios are most popular, since purchasers wishing to make rental investments principally choose these flats with small floor areas, which are more affordable than houses. Secondary seaside residences are highly sought after by foreign investors.

According to Douglas Martin, the manager of our Carte Financement French Riviera office: “Like certain districts of Nice, some areas in the Alpes Maritimes have wide price disparities. Proximity to the sea, the view, a lack of housing in certain areas, proximity to Monaco, Saint-Jean-Cap-Ferrat, Cannes La Croisette, etc.: all these criteria can distort prices, sometimes excessively. The clientele varies greatly depending on the type of project, whether purchase of a main residence, a rental investment or a second home. You will not be interested in the same property if you are seeking a good yield for an investment, whether or not requiring work, or if you are seeking an asset in an exceptional location which will not lose value. Finally, the international character of the region’s investors has transformed its property market and its prices profoundly. We are also working with property partners whose seriousness can be gauged by the way they specialise in geographical areas. “

Antibes is very close to Nice, and benefits from the competitiveness hub of Sophia Antipolis, and from its large English community. In the city centre average prices per m² are close to 4,462 Euros.

Cannes: secondary residences are profitable due to seasonal letting

The average price per square metre is 5,083 Euros, i.e. an increase of 11.5% over the past twelve months, according to the LPI-SeLoger barometer. According to MeilleursAgents.com, the local market is in fact quite difficult since there are 0.4 purchasers for each vendor.

Just as in Nice, prices vary in reality by a factor of two, depending on the districts. Prices in La Croisette or La Californie can go as high as 7,000 Euros/m² and even higher, depending on whether the property has a sea view, or other attractions. John Taylor recently sold a 73 m² flat in La Croisette for 2.3 million Euros. A few districts remain affordable, for example La Bocca (4,625 Euros/m²), La Source (4,510 Euros/m²) or La Croix-des-Gardes (3,661 Euros/m²).

Purchasers who wish to purchase a second home will be able to take advantage of the city’s international influence, and of the festival period, to lease their property on an occasional basis, which will guarantee a satisfactory ratio of rental payment/lease term.

Monaco, luxury property

Luxury property in the French Riviera property market is very well represented by Monaco, a city where one third of its inhabitants are millionaires. Currently, 97% of real estate property consists of flats which cost, on average, 54,486 Euros per square metre. These prices have almost tripled over the past ten years, and it is communes such as Roquebrune-Cap-Martin, Beausoleil and La Turbie which are benefiting from this rise.

Foreign purchasers, in particular British, Italians, French, Swiss but also Indians, and citizens of Middle Eastern countries, are helping to increase the attraction of the Monacan property market.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row]