The “non-dom” scheme was introduced in 1799 under George III by William Pitt the Younger, to shelter those who had real estate properties abroad against new war-related charges against France. This status has also favored certain colonial activities such as the cultivation of tobacco in Virginia and sugar cane in Jamaica. More than two centuries later, this device allows the British to appoint a foreign country as their place of residence. Then they are only taxed on the money they send back to Britain. In contrast, all their fortune accumulated in the world escapes the Crown. The recent questioning of this mechanism weighs on the luxury real estate market.

For the Financial Times editors, one can not say that the boss of HSBC has completely cut ties with his country. Not only that he works in London, but his children follows their education there. At the head of Barclays, John McFarlane, now some time before returning to the River Thames, is in the same situation.

Other well known figures like the Indian Lakshmi Mittal and Russian Roman Abramovich (owner of Chelsea football club) benefits as well.

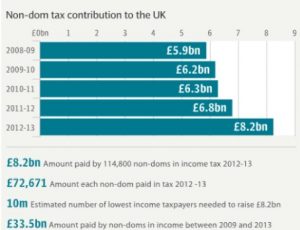

Indeed, the number of jetsetters and wealthy businessmen has increased in recent years according to the FT, from 83,000 in 1997 to 116,000 in 2013. Philip Augar, who worked at NatWest and Schroders, author of book ” Reckless: the Rise and Fall of the City”, in 2008, 10 to 15% of all employees of the City enjoyed this type of status.

It was common to negotiate low pay checks in London in exchange for the payment of larger offshore bonus. The City of London alone explains half the increase of non-residents for 1997. However, it also included in this, lot of workers who earns lower incomes, such as teachers or nurses.

The case of HSBC Leaks also showed that the Swiss banker suggested massively to wealthy individuals,such as footballers, to enjoy this status and domiciliate their assets in the Alps, to permanently escape all taxation.

Richard Caring, quoted by thoses leaks, was born in the UK. The fashion mogul owns the most selective restaurant in London namedThe Ivy. It is “non-domiciled” because his father was a former GI who moved to London after the war. His home located in the upscale area of London, is simply called “the Versailles of Hampstead”.

A gradual tightening of taxation on the non-doms

In 2008, the regime began to gradually become more restrictive. After seven years of living in the UK, you have to pay a package, which gradually rises up to £ 90,000, a paying tax to continue to benefit. According to some figures, admittedly a bit old and dates back to 2013, 5,080 non-doms have chosen to pay the tax.

In July 2015, a milestone was reached. George Osborne, the British finance minister, decided to end the “non-doms”permanently . Starting by 2017, this scheme will be reserved for those who spent less than fifteen of the last twenty years in the UK. Beyond this period, UK residents will be automatically considered fiscally domiciled in the UK. They will be subjected to tax on incomes, on capital gains and the real estate tax.

In some families, the award of that status to their children could last up to three generations without resistance.

This topic is a real headache. Margaret Thatcher, after an analysis of costs and benefits, had opposed to its removal. They hoped when Greek shipowners, refugees in Britain because they feared the Soviet Union, would ensure their activities in London.

This is a politically sensitive issue, especially since the abolition of the tax shelter wich is a strong claim of Labour, especially Ed Miliband.

This whole debate is also a witch hunting whiff tax exils lists appearing in the press and on Wikipedia.

Between new tax revenue and concessions

In the end, <ias part of their work, before returning to their country. Nevertheless, according to the Treasury, less than 20,000 people are really concerned by that type of living statuts.</i

To prevent any earthquake, some concessions were nevertheless dropped. The non-doms properties would be assessed on their value by April 6th 2017, which will prevent them from paying taxes on capital gains acquired since their acquisition. Transactional agreements could also be awarded for offshore funds held by non-doms.

The estimations of the fiscal impact of these measures varies according to observers. As for the Ministry of Budget, they could generate more than $ 300 million in tax revenue by 2020. Over the years, this reform could bring £ 1.5 billion in state coffers, but nobody can really assure those facts.

The tax impact of the presence of these exiles tax, contractors, etc, would not be insignificant.

In any case, if the 2008 warning has not transformed itself into exodus.

Defenders of the status quo, the escape of some tycoons could also have negative consequences on the quality of the Champion League, to some hospitals and, even lower donations to philanthropic works.

The most named cities who collects the fugitives are Paris, Dubai, Singapore and Switzerland.

Luxury Real Estate in Bern

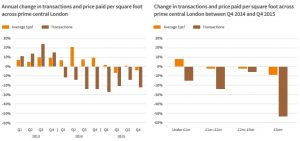

In 2015, those uncertainties have already brought down a third of real estate sales of over £M5 in London according to LonRes.

- Unusually, exceptional real estate houses are for sale in the Boltons, Royal Kensington and Chelsea, two neighborhoods where transactions are over £M15 which is extremely rare.

- For Morgan Stanley, 2016 should also register at an half-mast for the new apartments considerated the top of the basket.

The changes in the non-doms adds a series of tax increasement concerning the luxury real estate. Stamp duty on the most expensive properties was noted, and second homes will also be hit.

Some experts, however, consider that the wealthy ones are choosing Britain because of its political stability, its real estate legislation, its liberal economic regime, besides its luxury shops and its various recreational opportunities.

How to attract exiles with an attractive tax system

The Brexit also disturbs investors, who could follow the adage of Wait and See.

Recently, we have seen an 8% drop on trading volume in August 2014 in Scotland, during the referendum for independence.

According to the FT, some “predators” are sniffing the deal, they will not wait until 2017 to point their noses:

- Monaco’s embassy has just organized a party at the Royal Automobile Club in London to boast its sun and its Formula 1 Grand Prix

- Switzerland made a marketing campaign to tout his plan to package

- Even France has highlighted it’s expatriation regime